Housing values 1.5% higher in October as growth trends ease and downside risk builds

Australian housing values rose 1.5% in October, a similar result to August and September

However, taking the monthly change out another decimal point shows the market is continuing to slowly lose momentum since moving through a peak monthly rate of growth in March (2.8%). Nationally, the monthly growth rate eased to 1.49% in October from 1.51% in the previous month.

Although nationally the headline growth reading remains virtually unchanged over the month, across the broad regions of Australia market conditions are starting to show some diversity.

Perth recorded its first negative monthly result since June last year, with values nudging -0.1% lower. At the other end of the spectrum, Brisbane has taken over as the fastest growing market with housing values up 2.5% in October. This was followed by Adelaide and Hobart, with both dwelling markets increasing 2.0% in value over the month. In Sydney and Melbourne, the monthly rate of growth has more than halved since the highs seen in March 2021, when they reached a monthly growth rate of 3.7% and 2.4% respectively.

Across the regional markets, New South Wales (2.1%) and Queensland (1.9%) led the pace of capital gains while Western Australia was the only broad rest-of-state region to record a marginal fall in housing values (-0.1%).

According to CoreLogic’s research director, Tim Lawless, slowing growth conditions are a factor of worsening housing affordability, rising supply levels, and less stimulus.

“Housing prices continue to outpace wages by a ratio of about 12:1. This is one of the reasons why first home buyers are becoming a progressively smaller component of housing demand. New listings have surged by 47% since the recent low in September and housing focused stimulus such as HomeBuilder and stamp duty concessions have now expired. Combining these factors with the subtle tightening of credit assessments set for November 1, and it’s highly likely the housing market will continue to gradually lose momentum.”

Although the monthly pace of growth is easing, the annual trend has continued to rise, which is a factor of the stronger growth conditions throughout early 2021. Nationally home values are up 21.6% over the year to October, with half the capitals recording an annual growth rate in excess of 20%. Across the broad regions of Australia, regional Tasmania has led the nation for the pace of annual capital gains with dwelling values rising by 29.1%.

Unit markets have generally continued to record a lower rate of growth relative to houses, with this trend most evident in the annual results. In the largest capitals, Sydney house values are up a stunning 30.4% compared to a 13.6% rise in unit values, while in Melbourne house values rose 19.5% over the year compared with a 9.2% gain in unit values. This trend is less evident across regional areas of Australia where the performance gap between houses and units is relatively small.

For full article go to: https://www.corelogic.com.au/news/housing-values-15-higher-october-growth-trends-ease-and-downside-risk-builds?utm_medium=email&utm_source=newsletter&utm_campaign=20211101_propertypulse

New listings continue to rise!

New listings continue to rise, but are they in the areas where you want to buy?

Eliza Owen from Corelogic 20 October 2021

As lockdown restrictions ease across Sydney, Melbourne and the ACT, the spring selling season has started in earnest, and vendors are piling properties onto the market.

New listings have surged 28.2% nationally in the four weeks to mid-October, amounting to more than 45,000 new properties added to the market. The news could be a relief for buyers, because it means they have more stock to choose from after an extended period of relatively short advertised supply.

But this raises important questions: is the freshly advertised stock sitting in parts of Australia where people actually want to buy? Or, is this an indicator of vendors trying to offload properties that have not seen high levels of demand? Looking at listings data in more detail, it seems that the answer is a bit of both.

Unit stock is rising at a faster rate than houses

The COVID pandemic has shaped distinct preferences in housing demand, with detached houses proving more popular than units, and the biggest price uplifts occurring across coastal and lifestyle markets in the capital cities and regions.

Of the 45,171 new listings added to market over the past four weeks, 71.7% were houses, but this is down from a five-year average where houses typically make up 74.0% of new listing campaigns. Unit listings freshly added to market have risen 39% in the past four weeks, compared to a 24% rise in new house listings.

Figure 1 shows the rolling count of new listings through 2021 for houses and units nationally, compared with 2020 and the pre-COVID average. Compared with the pre-COVID five-year average, new house listings are still trending -5.5% lower. Meanwhile, unit listings are trending 11.2% higher. Given the relative popularity of detached housing through the pandemic, where national house values have increased 22.9% in the 12 months to September compared with a 12.0% rise in units, buyers may still find the volume of house listings relatively constrained.

Auctions Still The Way To Go

I wrote this article in April 2019. What a difference two and a half years make. Here we are in October 2021 in the middle of the biggest boom I have witnessed in 32-years of real estate. Still my advice of 2019 still holds true. A well conducted auction campaign remains the best way to sell your property. Now not so much as to secure the sale but to achieve the highest price. Without further editing, this is what I wrote in 2019.

The real estate market has transitioned. A boom market for five years to a declining market over the past two years. It is a fair question to ask, what is the best method of selling real estate? Does auction still reign as the predominate method of sale?

Auction clearance rates across Australia’s major cities continue to dip below what we were seeing at a similar time two years ago. Are auctions still the best way to market and sell your most precious asset. Auction clearance rates are now at around 50%, down from the heady days of an 80% at the peak of the market in June 2017.

Unconditional Sale

The benefit of an unconditional sale for a vendor has always been paramount. With an auction there is no subject to finance clause, no cooling-off period or any other conditions that tie vendors up for periods of uncertainty. In the current market, with some vendors unable to obtain finance or shopping around for the best deal, securing an unconditional sale has an even greater imperative.

All Is Not Lost

A common misconception of the auction process is that if not sold on the day, the auction is a failure. We challenge that notion. Auction has often been described as a three-stage process where you can sell before the auction, at the auction or after the auction.

Whilst this is true, a sale before auction should always be treated with extreme caution. First, you need to secure an unconditional sale. Secondly, as the vendor or vendor’s agent, you need to be assured that the price accepted is the best that will be offered, within the predetermined marketing period.

Trying to secure an early result, may rule out many prospective purchasers. Some, who may ultimately be better financed but who still need to cross their t’s and dot their i’s.

Control The Process

Another of auctions great advantages is that the vendor’s agent gets to control the timing of the sale and pace of negotiations. This advantage is lost in private treaty methods of sale. Difficult to master with other methods such as tender or expressions of offer. The not so subtle art of smoke & mirrors often frightens off wary buyers. Control the process, don’t let the process control you!

Transparency & Honesty

New legislation around price guides has brought greater transparency and certainty to the auction process. We believe this level of transparency needs to be elevated to the next level. Provide potential purchasers with free copies of pre-purchase building reports or Strata Reports. Even if your property has issues, which all properties do, it is better to control the information flow to purchasers. The alternative is that they have control of vital information of which the vendor may be unaware. Providing information is the best way to disarm purchaser’s concerns and gain their confidence in proceeding through with the sale.

In a down market prospective buyers perceive private treaty sales as being “Open to Offers” and being over-priced. This may result in prospective buyers making wildly low opening offers, from which there is no way back; or sitting out of the market waiting for your asking price to fall. If a vendor is on the market at auction, they are a genuine willing seller prepared to meet the market; as opposed to a passive seller. We all like to deal with genuine people.

Sales agent for Di Jones on Sydney’s Lower North Shore Nicole Grady-Combess says people ask her about different selling methods and a lot of agents try to get in through off-market.

“In a market with fewer buyers and less competition, you need to be on the market. You need to be exposed. A deadline-driven process is the best method, it gives buyers and vendors something to work towards,” says Combes. “Irrespective of the noise going on in the press, auctions keep people focused on the goal.”

“Last year, vendors had high expectations about what they could get for their property, and buyers had much lower expectations. Now there is data, which buyers and sellers can’t argue with. The distance between their mentality has significantly reduced,” she says.

Ultimately the objective of any marketing campaign is to achieve a sale of the property at the best available price. Even if the property is passed in at auction, chances are it will be sold to someone who was introduced to the property during the auction period.

Shane Spence the Licensee In Charge of Shane Spence Real Estate on Sydney’s Northern Beaches says, successful purchasers often find the property in the first two weeks of marketing.

“The rest of the time is spent determining, which buyer is best prepared to pay the highest price and negotiating a close of sale. Many agent’s force the sale before auction, often to the disadvantage of their clients. Patience is a virtue in any negotiation. Often rewarded by a higher price and a more satisfying experience for both vendor and purchaser.”

Measuring the effectiveness of auction v other methods of sale is difficult. Whilst auction statistics are updated regularly there is less evidence available for other methods of sale. Anecdotally however, it is clear that many private treaty sales have floundered. Vendors have been forced to adjust their prices in order to attract disinterested purchasers. Auction continues to allow the vendor to be on the front foot. Vendors who auction their property dictate the terms of sale. Even at 50%, auctions are achieving a strong result in just four weeks. Whilst many more are being cleaned up a week or two after auction.

Life Of Tenants

Ten Things Government Could Do To Improve Life For Tenants

With elections looming in both NSW and Federally, most parties are bringing out policies which they think will appeal to tenants. Fair enough, tenants represent something like 40% of the population, possibly more in certain seats. Many of the policies I have read include such things as: ruling out No Fault Terminations or; limiting the level or frequency of rent increase, will no doubt appeal to many tenants. They may not however appeal to landlords who represent an equally large section of the voting public.

I have put my thinking cap on and I have come up with 10 ideas, which I feel will have far greater impact on the lives of all tenants.

- Ensure rent increases meet market value. There is a push by some to restrict rent increases to CPI. Whilst the housing index no doubt flows into the CPI calculations, the rental market has its own set of supply and demand forces. If the supply of housing falls below demand, rents increase. Landlords will be encouraged into the market in order to take advantage of higher rents. Market pressures will be brought back into balance. Rent increases will stall. At the moment rents are falling due to an over supply of properties in the rental market. This was brought about by a 5-year property boom, which was fuelled by investors buying into the market. By placing any price restriction on any market, you remove the essential market mechanism. Think back to what happened in the wool industry when a floor price was in place. A CPI price restriction will at certain times discourage new investors in to the market and could encourage some existing investors to leave; thereby exacerbating the shortage of available properties. This is exactly what happened in the bad old days of protected tenancies after WWII. Not only did the pool of private rental properties dry up, public housing had to increase to fill the gap and existing properties were maintained at a minimal level. The answer is to establish a register of rent increases via the Rental Bond Board’s, Rental Bonds Online (RBOL) Service. These figures could be monitored and made available to the tenants, real estate agents and the public.

- Ensure tenants have access to solar generated power by establishing Strata Titled Solar Farms located in rural areas. Tenants or other strata unit owners, could buy an entitlement into the Solar Strata Plan in order to subsidize their power costs. Tenants or owner occupiers of units would be eligible to government rebates or interest free loans as may exist from government to government.

- Only allow negative gearing and capital gains benefits on new properties. This will have the long-term effect of increasing the pool of newer homes available for rent and lower the average age of rental properties; thereby increasing the quality of facilities available to tenants. This is similar to, removing old cars off our roads, with the resulting affect we now have a much younger fleet of cars; which are safer, more comfortable and more fuel efficient than older vehicles.

- Place a mandatory age limit on properties, which can be leased. Tenants are often left with no choice but to lease properties, which do not meet current standards. For example: We live in a modern society with a high dependence on electrical appliances. Units built prior to the mid 1970’s only have 32 amps of power available. After the mid-70’s newer buildings have 63 amps supplied. Putting this in context, a 50 litre hot water system draws 15 amps, add to this an oven at 10 amps and 5 amps for each electric hot plate; and 16-20 amps for all power points (a portable AC unit generally draws about 10 amps). It is not hard to see why in early winter, tenants in older units experience inconvenient blackouts. Similarly, many balcony hand rails, fire safety, ceiling insulation do not meet current acceptable standards. A mandatory 50-year rule should be introduced. Properties older than 50-years need to be completely refurbished to current standards. They would need to be certified before they can re-enter the rental market.

- Make Owners Corporations subject to the Residential Tenancy Act. As any tenant or property manager will tell you (and NCAT members) getting Owners Corporations and Strata Managers to do anything which involves resolving a tenancy issue is near on impossible. For example: a garage door frame needs repair. The responsi9bility of the owners corporation. The owner, tenant and property manager are at the mercy of Strata Managers and Owners Corporations to decide in what time frame this might be completed. As the Owners Corporation also represent the landlord owners of a building, it only makes sense that Owners Corporations should be subject to the Residential Tenancy Act

- Introduce a pet bond. Many tenants want to have a pet. Tenants are often prevented from doing so because of justifiable fears of landlords and property managers. Pets of the potential damage to flooring, walls and other soft furnishings. Many landlord insurance companies now include a pet clause, which covers damage by pets. The next step is to introduce a pet bond, which would be sufficient to cover the potential cost of replacing a depreciated value of some of these items. Thereby placing some of the onus of care on the person wanting to keep a pet.

- Improve the educational requirements of all Real Estate Agents and reintroduce a minimum 2-year work experience rule for Licensees. This is an old issue for many in the industry. Successive governments have reduced the educational requirements of entering the industry. They have also removed the requirement of a minimum 2-year work experience prior to becoming a Licensee. The rational has been that making entry into the industry easier will increase competition. The result has been to reduced the knowledge and experience level of the industry.

- Require Landlords to complete an annual online educational course. There are many landlords who choose to go it alone without the assistance of a real estate agent. Equally, there are many landlords who use a real estate agent but ignorant their advice. Requiring landlords to complete an online CPD style course will keep them abreast of their obligations.

- Clarify the rules around sub-letting and mandate that sub-tenant bonds are lodged with RBOL. It is one thing allowing tenants to sublet part of their rental property. The sub-tenant is often at the mercy of a head tenant; who has no idea of their obligations. Head tenants who sub-let out properties have become landlords / agents. Head tenants need to complete a CPD course before they can sub-let. It should be mandatory for all bonds collected by a head tenant be lodged with RBOL

- Ensure short term furnished rental properties meet the same quality and safety standards as hotels. Whilst not directly related to the residential rental market, the rise of AirBnB and other short term holiday accommodation premises has reduced the pool of residential properties in some areas. These properties are commercial rentals not residential rentals. Often an owner will throw in old furniture from their home and think job done. Theses holiday lettings are often located in rersidential strata unit buildings. These properties do not meet the fire safety standards noise standards or security standards of hotels; against which they are competing for market share. They do not necessarily have fire rated carpets, curtains and bedding, fire rated doors, back to base fire alarms, a 24/7 emergency repair service, noise proof floors, ceilings doors or walls. These issues impact on the comfort and safety of other occupants in the building – including tenants who in some buildings represent the majority of occupants.

Another Thing We Do

We act on behalf of an elderly client for whom we manage several investment properties. One of his properties required a new roof. The original roof was beyond repair. A new roof would come with lambs wool insulation and whirlybird. The result was a significant reduction in the temperature of the property in summer and added warmth in winter.

Not only have we assisted in maintaining his property but have added a great deal of value to his property. At the same time, we have added to the comfort of our tenants and reduced their cost of heating and cooling the property.

A win win situation for everyone.

We would like to thank and recommend our tradesman Benny’s Roofing, who completed the work in 3-days. On time and on budget!

Shane Spence Real Estate is celebrating 21 years of operation from their Fairlight suite. We are specialists in sales and property management. If you need the services of a fully qualified real estate agent with over 30-years of experience on the Northern Beaches, call Shane on 0412 226 722 or email shane@shanespencerealestate.com.au

Another Thing We Do

Many people think that as a real estate agent, you just sell properties or collect the rent! As if that wasn’t enough in itself.

What we do is to maximise the value of our clients property.

Here is an example:

This delightful 1940’s P&O style duplex in Fairlight, was built by the clients parents. The windows are original and despite some effort to maintain them, they have progressively become worse over time. The client is a stickler for maintaining the property in its original art deco style.

With the assistance of our carpenter Aaron Peachey of AJP Building & Maintenance and our painter Victor Cirera, we have arranged for new timber sliding and sach windows by Airlite Windows to be custom made, installed and painted. Thereby maintaining the integrity of the property.

Shane Spence Real Estate is celebrating 21 years of operation from their Fairlight suite and is a specialist in sales and property management. If you need the services of a fully qualified real estate agent with over 30-years of experience on the Northern Beaches, don’t fail to call Shane 0412 226 722 or email shane@shanespencerealestate.com.au

Untapped granny flat potential

CoreLogic Research News •

Potential 655,000 Granny Flat Sites

New analysis of all residential properties across Australia’s three largest capitals has identified more than 655,000 sites suitable for the construction of a granny flat, offering a solution to help ease the housing shortage.

Granny flats: Where are the greatest opportunities for development? by national town planning research platform Archistar, real estate construction lender Blackfort, and property data and analytics provider CoreLogic assessed every residential block across Sydney, Melbourne and Brisbane to determine how many individual properties have building potential for a self-contained two-bedroom unit.

Sydney is home to the most granny flat development opportunities with around 242,000 suitable properties, representing 17.6% of the metro region’s housing stock. Melbourne has almost 230,000 potential sites, representing 13.2% of stock, while Brisbane has almost 185,000 suitable sites, representing 23.3% of houses across the metro region.

Of these sites, more than a third (36%) are within two kilometres of a train or light rail station and 17% have a hospital within the suburb boundary, demonstrating a combination of accessibility and opportunity to fast-track housing options for essential workers in the health care sector.

CoreLogic Research Director Tim Lawless said the results highlight significant untapped development potential which could go some way toward fast tracking a partial remedy to the housing shortage in the country’s largest cities.

“NHIFC forecasts indicate the national housing market is likely to be undersupplied to the tune of 106,300 dwellings over the next five years,” Mr Lawless said.

“For policy makers and government, granny flats present an immediate and cost-effective opportunity to deliver much needed housing supply within existing town planning guidelines. For homeowners, the addition of a second self-contained dwelling provides an opportunity to provide rental housing or additional accommodation for family members, while at the same time, increasing the value of their property and potentially attaining additional rental income.”

Archistar co-founder Dr Benjamin Coorey said accommodating the growing population within these larger capitals is a critical issue that flexible housing solutions can help address.

“Since granny flat developments leverage existing lot areas and require no changes to town planning regulation, they offer an immediate opportunity to address housing shortages and affordability pressures expected in the coming five years for both buyers and renters.”

Top Sydney council regions and suburbs

Sydney is home to the most granny flat development opportunities, with 242,081 existing residential dwellings fitting the zoning, land area and existing home position requirements to build a granny flat.

Across Sydney’s council regions, the Central Coast hosts the most granny flat development opportunities, with 41,569 or 17.2%, of all potential sites. The Northern Beaches (19,884 / 8.2%), Hornsby (18,344 / 7.6%), Blacktown (17,909 / 7.4%) and Ku-Ring-Gai (14,617 / 6.0%) round out the top five regions.

At a suburb level, neighbouring North-West suburbs show the highest opportunities for granny flat development. Baulkham Hills (4,673 / 43.3%), Castle Hill (4,423 / 39.8%), Cherrybrook (3,421 / 61.8%), Carlingford (2,910 / 46%) and West Pennant Hills (2698 / 49.3%) stand out due to their larger land areas compared to inner-city neighbourhoods.

“Sydney’s household formation is forecast to outpace supply from 2025, with the most significant undersupply expected through 2025 and persist up until 2026 at -15,900 dwellings,” Mr Lawless said.

Granny flat development benefits

Mr. Lawless said there are immediate lifestyle and financial upsides for investors whose properties met the planning requirements.

“Adding a granny flat accommodates extra living space for extended family, multi-generational households or rental purposes, thereby boosting a property’s value and potentially creating extra income for rising living costs.

“CoreLogic figures show an extra two bedrooms, and an additional bathroom could add around 32% to the value of an existing dwelling. For a house worth $500,000, the addition of a granny flat has the potential to add approximately $160,000 to the value of the property.”

Dr Coorey said research showed more than a third of the sites identified are close to existing amenities and services such as transport or a hospital.

“Granny flats present a cost-effective opportunity to boost housing supply for growing capital populations close to existing infrastructure such as railways, bus routes and major road networks for state and local governments.

“While building regulations for secondary dwellings differ state to state, this unlocks a combination of accessibility and opportunity to fast track affordable housing options for all demographics, particularly essential workers in industries such as the health care sector.”

For more information, visit https://www.archistar.ai/granny-flat.

FRESHWATER SUBURB REPORT OCTOBER 2023

Market Report for Freshwater (2096) based on a CoreLogic suburb commissioned by Shane Spence Real Estate as of 10 October 2023

Suburb_Report_Freshwater_NSW_2096_Tu-24-2023:

SALES MARKET

House Prices: Freshwater’s median house price have recovered from their recent low in December quarter 2022 ($3,000,000). Prices for the June quarter 2023 achieved a median value of $3,300,000 ($3,525,000 for the previous 12-months). This is a strong result, just shy of the record of $3,600,000 set in the December quarter 2021. As with many other local suburbs, this recent recovery can be attributed to lower than normal stock levels, indicating that vendors are hesitant to list their properties for sale during a period of economic uncertainty. Prices have increased steadily since the RBA paused interest rate increases in April 2023. Whilst there were subsequent increases, this pause signalled to the market that the RBA was nearing the end of its policy of monetary policy restraint.

Unit Prices: The unit market in Freshwater has recovered at a much more modest rate than houses. Median prices only increased to in the order of $1,050,000 as at the June quarter 2023 ($1,000,000 for the 12-months to 31 June 2023). Well down on the peak recorded December quarter 2021, which was just below $1,300,000. Stock levels of units in Freshwater are well in line with normal market expectations.

RENTAL MARKET

House Rents: Median house rents in Freshwater have accelerated strongly $1,400 per week, which represents a new high for the suburb. In June 2018 the median price for houses in Freshwater was $1,250PW, which means house rents have increased 12.0%PA in that 5-year period or 2.4%PA. Gross rental yields for houses have however declined during that period from 2.6%PA to 2.4%.

Unit Rents: Median unit rents have reached a new high of $650PW, indicating an upward trend in unit rental prices. To provide some perspective, median unit rents in Freshwater in 2018 were $600PW. This represents only an 8.3% increase in 5 years, equating to a modest 1.6%PA increase in rents over that period. Over the same period, Gross Rental Yields fell off the cliff from December 2019 to June 2022 from 4.0%PA to 2.8%PA. Gross rental yields have since back to a respectable 3.5%PA.

The current rate of inflation in the June Quarter of 2023 is reported as 6.0% per annum.

Please note that these figures and trends are based on the data available as of 10 October 2023, and the real estate market can be subject to various factors that may influence these numbers in the future.

DISCLAIMER

The views expressed in this report are the opinion of a licensed real estate agent. This opinion is not a valuation, should not be construed to be a valuation and should not be relied upon for any purpose. Interested parties should make their own independent enquiries. These views do not relate to any particular property and do not constitute financial or investment advice. Interested parties should seek the advice of independent and qualified financial and investment advisers and make their own enquiries.

Mondegreen a misunderstood word or phrase from misinterpreting something said or written. If there is something you are not quite sure of, please feel welcome to call me for an explanation.

Abyssinia, Samoa, Ceylon, Moscow

I’ll be seeing you some more, so long, must go!

Manly Suburb Report

Manly Suburb Report October 2023

Based on a CoreLogic suburb report for Manly commissioned by Shane Spence Real Estate (see link to the full report below) as of 10 October 2023:

Sales Market

House Prices: Manly house prices have rebounded from their recent low in December quarter 2022. Prices for the June quarter 2023 achieved a median value of $4,301,014. Which demonstrates the resilience of this consistently high performing suburb. This latest result is just shy of the record of $4,450,000 set in the December quarter 2021. This recovery can be attributed to lower than normal stock levels, indicating that vendors are hesitant to list their properties for sale during a period of economic uncertainty. Prices have increased steadily since the initial pause in interest rate increases in April 2023, which signalled to the market that the RBA was nearing the end of its policy of monetary policy restraint.

Rental Market

Please note that these figures and trends are based on the data available as of 10 October 2023, and the real estate market can be subject to various factors that may influence these numbers in the future.

Disclaimer

The views expressed in this report are the opinion of a licensed real estate agent. This opinion is not a valuation, should not be construed to be a valuation and should not be relied upon for any purpose. Interested parties should make their own independent enquiries. These views do not relate to any particular property and do not constitute financial or investment advice. Interested parties should seek the advice of independent and qualified financial and investment advisers and make their own enquiries.

Mondegreen a misunderstood word or phrase from misinterpreting something said or written. If there is something you are not quite sure of, please feel welcome to call me for an explanation.

Abyssinia, Samoa, Ceylon, Moscow

I’ll be seeing you some more, so long, must go!

Fairlight Suburb Report

Fairlight Suburb Report October 2023

Based on a CoreLogic suburb report for Fairlight commissioned by Shane Spence Real Estate (see link to the full report below) as of 10 October 2023:

Sales Market

House Prices: Fairlight’s house prices have rebounded from their recent low in December quarter 2022. Prices for the June quarter 2023 achieved a median value of $3,600,000. This is a strong result, just shy of the record of $4,000,000 set in the December quarter 2021. This recent recovery can be attributed to lower than normal stock levels, indicating that vendors are hesitant to list their properties for sale during a period of economic uncertainty. Prices have increased steadily since the initial pause in interest rate increases in April 2023, which signalled to the market that the RBA was nearing the end of its policy of monetary policy restraint.

Rental Market

Please note that these figures and trends are based on the data available as of 10 October 2023, and the real estate market can be subject to various factors that may influence these numbers in the future.

Disclaimer

The views expressed in this report are the opinion of a licensed real estate agent. This opinion is not a valuation, should not be construed to be a valuation and should not be relied upon for any purpose. Interested parties should make their own independent enquiries. These views do not relate to any particular property and do not constitute financial or investment advice. Interested parties should seek the advice of independent and qualified financial and investment advisers and make their own enquiries.

Mondegreen a misunderstood word or phrase from misinterpreting something said or written. If there is something you are not quite sure of, please feel welcome to call me for an explanation.

Abyssinia, Samoa, Ceylon, Moscow

I’ll be seeing you some more, so long, must go!

Four Major Errors Sellers Make

We all know the mnemonic device, i before e except after c.

And in the main this rule is true. There are however exceptions: weird, foreign, leisure, seize, forfeit, height, protein, caffeine, forfeiture, codeine, heifer, efficient, ancient, conscience, and sufficient. There are exceptions to every rule.

So here are four major errors sellers commonly make when selling their home. Generally, making these mistakes will result in them not maximising their sale price.

Before you call me and start telling me that you did exactly this or that and got a great price, congratulations. That is fantastic but it is my job to plan to succeed. Not to fail to plan.

Rule # 1: When selling, Never Be Impatient

Here are the four common mistakes vendors (and agents) do when selling real estate.

Bigger Is Not Always Better

Shane Spence: Best Real Estate Agent In Fairlight

It may sound a boastful claim but since Shane Spence Real Estate is the only real estate agent based in Fairlight, it is one which is easy to make. But that is not what makes Shane Spence the best real estate agent in Fairlight. To Shane, representing his clients is a personal thing. The successes he achieves, are not as important as the manner in which he achieves them. The commissions he earns are secondary to satisfaction of a job well done. Nothing is worth doing unless there is a sense of pride and integrity in the work one does.

In the world of real estate, finding the right agent can make all the difference.

In the harbourside suburb of Fairlight, one name stands out as the best real estate agent: Shane Spence. With a proven track record of excellence and a deep commitment to his clients, Shane has earned his reputation as the go-to agent in this sought-after community.

Shane Spence brings a wealth of experience to the Fairlight real estate market. With over three decades in the industry, and 26 in Fairlight, he possesses an intricate knowledge of the local property landscape. Fairlight, with its harbour scenery, charming homes, and intimate community, requires an agent who understands the intricacies of the local market. Shane’s expertise in Fairlight real estate is unparalleled, making him the perfect choice for buyers, sellers, landlords and tenants.

What sets Shane apart is his dedication to his clients. He takes the time to listen to their needs and aspirations, ensuring that every transaction is a personalised experience. Whether you are selling your family home or investment property, are buying or leasing Shane’s goal is to achieve the best possible outcome for you.

In the competitive Fairlight market, Shane’s marketing skills shine brightly. He has access to the major real estate portals, produces quality photographic material, and engages the services of leading stylists, and tradesmen to showcase your property in the best light possible. His comprehensive approach ensures that your property receives maximum exposure, attracting potential buyers from far and wide.

Shane’s reputation for integrity and transparency precedes him. He believes in building long-term relationships with his clients, which is why many return to him for their real estate needs time and again. Shane often goes that extra mile to assist his clients, above a beyond what is expected of him. His honesty and professionalism are qualities that have earned him the trust of the Fairlight community.

When it comes to Fairlight real estate, Shane Spence is undoubtedly the best agent you can choose. His experience, dedication, and passion for the community make him the ideal partner for your real estate journey. Whether you’re buying or selling, Shane’s expertise will guide you through the process with confidence and success.

Shane is readily available to take you call. If you wish to speak to him, call 0412226722.

Discovering Fairlight

A Historical Journey Through Fairlight NSW 2094

The history of any local area is intertwined with the development of the local real estate. Before European settlement the local indigenous people were engaged in activities which used and enhanced the local environment.

Welcome to Shane Spence Real Estate, your trusted partner for all your real estate needs in the picturesque suburb of Fairlight. Beyond helping you sell or to buy your dream Fairlight property, we believe in providing you with insights into the community you’re becoming a part of. Let us embark on a brief historical journey through the charming suburb of Fairlight.

Indigenous Roots

Long before the arrival of European settlers, the land that would become Fairlight was home to the Guringai people. The original custodians of this coastal region. These indigenous communities lived in harmony with the land and sea, leaving behind a deep cultural and historical imprint. Sydney Road, which runs along the spine of Fairlight, was a well-worn track formed by the indigenous community. Similarly what is now known as Lauderdale Avenue was used by the local indigenous families to access harbourside fishing spots. If you look closely enough, you will still find evidence of middens around the harbour.

The neighbouring suburb of Manly is well known as having been named so by Governor Macquarie. He is reported to have remarked about “manly stature” of local inhabitants. Unfortunately, his admiration of their proud appearance, did not save him from being speared soon after visiting Manly Cove.

Early European Settlement

Fairlight’s European history began in the early 19th century not long after European settlers arrived in Sydney. The area was initially used for farming and timber, with sprawling estates and agricultural endeavours dotting the landscape.

Fairlight takes its name from Fairlight House built by Henry Gilbert Smith (1802-1886) the founder of Manly Village. The house was named after Fairlight, East Sussex.

Fairlight was originally only the area near the beach where Fairlight House once stood. The suburb at the top of the hill was called Red Hill, due to the pre World War II red gravel surface of Sydney Road. Over the years Fairlight has lent its name to several Ferries.

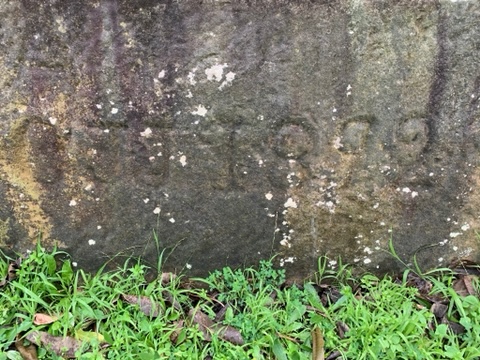

Part of a stone wall on Sydney Road, Fairlight not 20 metres from Fairlight shops dated 1892

The Rise of Transportation

The transformation of Fairlight into the vibrant community it is today can be attributed to the arrival of the ferry service in the 1850s. This was, and still is a convenient mode of transportation to and from Sydney’s CBD. People from the city flocked to the area, drawn by its stunning beaches and pristine waters. There remain a few workers cottages in Fairlight from these early days.

In the early 1900’s a tram service ran through Fairlight along Sydney Road between Manly, the Spit Bridge, and to destinations far north as Narrabeen.

Today, there is continued discussion regarding harbour crossings and the potential for the return of rail services to the Northern Beaches. Fairlight continues to be well serviced by the Manly Ferry terminal and express bus services to Sydney CBD, Chatswood and the Northern Beaches.

Fairlight and Manly

It is impossible to talk about Fairlight without mentioning its close neighbour, Manly. The two suburbs share a rich history, as the growth and development of one often mirrored the other. Even today the fortunes of Fairlight are tied to those of Manly, its ferry service, entertainment district, surf beaches and bush reserves.

World War II and Battery Park

During World War II, Fairlight took on a significant role in the defence of Sydney Harbour. Battery Park, a coastal artillery battery, was established to safeguard against potential naval threats. Today, Battery Park stands as a testament to this history and serves as a public space with historical remnants and breathtaking views of the harbor.

Residential Development and the Post-War Era

The post-war period saw increased residential development in Fairlight, with many homes taking advantage of the suburb’s idyllic coastal location. Fairlight’s proximity to Manly meant residents could enjoy the amenities of the larger town while still savouring Fairlight’s quieter ambiance. In those times, Fairlight had among other retail outlets, three butchers, a green grocer, and a haberdashery shop.

A far cry from today. Fairlight’s strip shopping centre now has three cafes and two restaurants, a number of hairdressers, doctors and professional services.

Heritage Preservation

Fairlight’s rich history is celebrated through the preservation of heritage-listed buildings and landmarks. Scattered around Fairlight are original sandstone walls, and curbing. Much of this sandstone was taken from a quarry on Sydney Road which supplied this uniquely Sydney building material to many homes, local buildings and public works. The area is noted for many fine examples of Colonial, Victorian and early Federation houses.

Modern Fairlight

Today, Fairlight remains a sought-after residential area known for its elegant homes, stunning waterfront properties, and a strong sense of community. Its historical significance is intertwined with the contemporary living experience it offers. Whilst their remain many fine examples of earlier building styles, many homes are making way for stunning modern architecture taking advantage of light and views.

Residents of Fairlight enjoy the best of both worlds – the tranquillity of this beautiful coastal suburb and the convenience of being just a stone’s throw away from Manly’s vibrant hub. The stunning views of Sydney Harbor and its accessibility to amenities make it a coveted destination for those seeking a harmonious blend of history and modern living.

As Fairlight continues to evolve, it remains firmly rooted in its storied past. Its history is preserved in the character of its streets and the warmth of its community. When you become a part of Fairlight, you’re not just buying a property; you’re becoming a part of a rich tapestry of history and a promising future. And at Shane Spence Real Estate, we are here to guide you every step of the way on this incredible journey in Fairlight, NSW 2094.

Investors Opting Out

High Interest Rates, Increased Regulation

For a number of reasons, it appears there is an increasing number of investors opting out of the market. At a time when supply of investment properties is at a low and demand is at an all time high, this cannot bode well for renters. The squeeze on rental returns is at an all time low. When I first started in real estate in 1990, the conventional rule of thumb was that an investor could expect to achieve a steady, 5% gross rental return. Over the years, this has declined to below 3.0% for a unit and 2.3% or less for a house. Remembering these are gross rental returns. After expenses and land tax, net rental returns may be below 2.0% for a unit and 1.5% for a house.

Critics will rightfully point to high capital gains. Here on the Northern Beaches capital gains have been in the order of 155% over the last 10-years. I am guessing that might be around 400% over the past 30-years of my career.

So why are investors selling up. One reason may be that Baby Boomers who have been the much maligned predominant group investing in real estate are getting older; selling up their assets to fund their retirement. More recent investors who have extended their finances when interest rates were low, are selling up to avoid crippling high interest rates, which are not off set by rents; despite recent rent increases. And my own personal belief is that many investors are frightened by the talk of rent freezes, rent control and other regulations such as the banning of no-reason termination notices, and pet regulations and are thinking it is all just getting to hard for too little return.

The article below from Corelogic, talks about the impact of interest rate rises and the impact on investors selling out of the market. To read the full article by Eliza Owen of Corelogic go to: https://www.corelogic.com.au/news-research/news/2023/as-rates-rise-and-times-get-tough,-property-investors-opt-out-of-market?utm_medium=email&utm_source=newsletter&utm_campaign=au-rea-property-pulse-2023-jun

As rates rise and times get tough, property investors opt out of market

There’s been plenty of attention on the supply and demand deficit contributing to the Australian property market’s resilience. As of May, new listings added to the market were -20% below the previous decade monthly average across Australia and the ‘months of supply’ ratio, which measures the amount of time it would take to deplete stock based on the current rate of home sales, fell to 1.8 months in May.

Interestingly though there’s a stark difference between the market’s overall listings trend and investor behaviour at present. CoreLogic infers which listings are investor-owned based on the rental history of a property. Based on these estimates, new investor listings brought to the market over May are only -2.9% lower than the previous decade monthly average.

In three capital cities – Sydney, Melbourne and Perth – investor listings for May were actually higher than the previous decade average.

At a more granular level the proportion of investor listings on the market in May has shot up in inner city areas, traditional hot spots for multiple property owners.

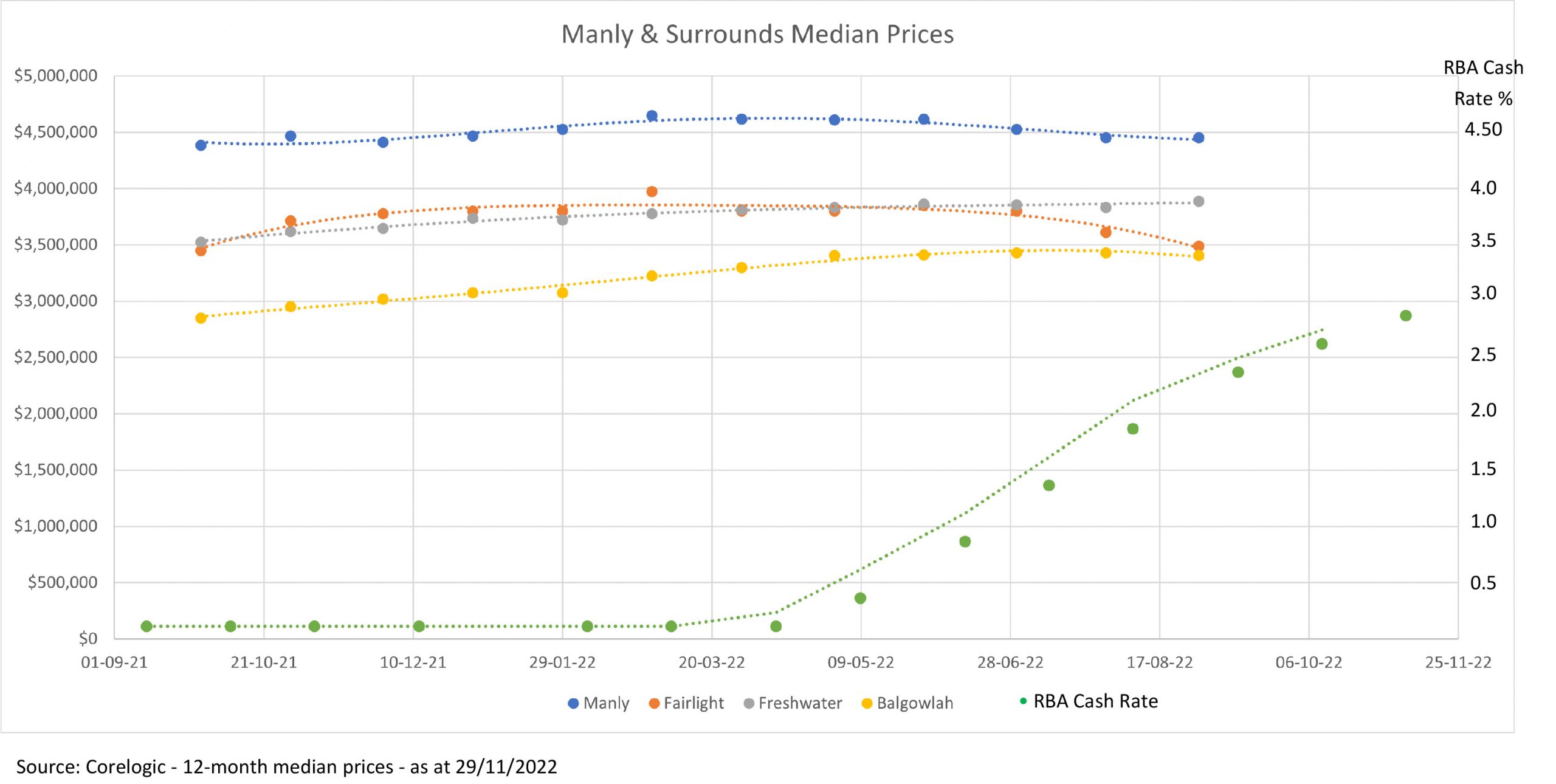

Manly Real Estate Prices Hold Firm

Despite the best efforts of the Reserve Bank to dampen inflation and with it the housing market, the local Manly (NSW 2095) market has proven its resilience by refusing to buckle under the weight of interest rates rises.

Looking at the local suburbs of Manly, Freshwater, Fairlight and Balgowlah prices in the six month period after interest rates started to rise (April to August) have levelled off. Both house and unit prices have stopped increasing. But interestingly, neither the local house or unit market have fallen significantly, if at all. The small turn over of stock in the local market, means that any small variation in prices from month to month may be no more than a statistical blimp. These variations easily attributable to the differences in quality or location of properties on offer from time to time.

Because many local agents do not disclose their sale results, it is difficult to get a clear picture of what has happened in September – October. The few sales results which have been published would tend to indicate that the local market remains strong. This may be a fool’s assumption, which might be proved incorrect once the official figures are released.

It has long been the case in this area that if vendors do not believe they will achieve their prices, they simply do not put their properties to market. This results in a stock shortage which in turn holds up prices. This would appear to be the case with a 20% decline in the number of properties being listed in the 12-months to August (Houses 60) from the peak in February 2022 (Houses 75).

Recent Median Sale Prices (houses)

Recent Median Sale Prices (houses)

| Suburb | March | April | May | June | July | August |

| Manly | $4,615,000 | $4,607,500 | $4,616,000 | $4,525,000 | $4,450,000 | $4,450,000 |

| Fairlight | $3,800,000 | $3,800,000 | $3,850,000 | $3,800,000 | $3,610,000 | $3,490,000 |

| Freshwater | $3,810,000 | $3,832,500 | $3,865,000 | $3,855,000 | $3,832,500 | $3,887,500 |

| Balgowlah | $3,300,000 | $3,405,000 | $3,410,000 | $3,430,000 | $3,430,000 | $3,405,000 |

Recent Median Sale Prices (units)

| Suburb | March | April | May | June | July | August |

| Manly | $1,872,000 | $1,915,000 | $1,950,000 | $1,945,000 | $1,880,000 | $1,900,000 |

| Fairlight | $1,685,000 | $1,710,000 | $1,650,000 | $1,655,000 | $1,710,000 | $1,695,000 |

| Freshwater | $1,140,000 | $1,144,000 | $1,125,000 | $1,130,000 | $1,122,000 | $1,118,000 |

| Balgowlah | $1,550,000 | $1,560,000 | $1,500,000 | $1,500,000 | $1,382,000 | $1,310,000 |

Statistics are calculated over a rolling 12-month period

Rules for working with vendor advocates

WARNING

Vendor advocates offer services to assist with selling a property. These services include advice on choosing a real estate agent and negotiating an agent’s commission. This is not to be confused with a Buyers Agent. If you’re a vendor advocate, or are an agent working with them, it’s important to be aware of the NSW Fair Trading laws that apply.

Shane Spence Real Estate does not work with Vendor advocates. We may from time to time enter into referral arrangements with fully licensed agents. Our experience is that Vendor advocates add very little to the Vendor’s experience. They simply advise Vendors of all agents with whom they have a financial arrangement. They are ensuring they pick up a proportion of the commission irrespective of which one of their agents is successful.

Intermediaries must tell consumers about their commissions and referral fees

Since 1 July 2020, the Fair Trading Act 1987 requires all intermediaries such as agents and vendor advocates, to tell vendors about any commission or referral arrangements they have with another supplier before acting on the vendor’s behalf.

‘Find an agent’ and any other services offered by vendor advocates are included in this law. These services often appear to be free to the consumer but can hide the fact the service is being paid for by the agent who receives the referral. Vendor advocates must tell the vendor if they have any financial arrangements such as commissions or referral fees.

The maximum penalty for not declaring third-party arrangements is $22,000 for an individual and $110,000 for a corporation.

It is against the law for agents to share an amount of the final sale commission with a referral service or any unlicensed person. The maximum penalty for breaching this prohibition is $11,000 for a corporation or $5,500 for an individual.

Fair Trading will continue to monitor the market for unlicensed conduct and take further action where necessary.

Licensing requirements

If a vendor advocate performs any real estate sales functions, they must hold a licence. Standard ‘find an agent’ referral services are not included in the law’s definition of real estate sales and leasing functions those providers do not require a licence. (Refer to the Property and Stock Agents Act 2002.)

Visit the using an agent webpage on the NSW Fair Trading website for more detailed information on licensing and other laws that apply.

Recent Comments