Housing turnover reaches the highest level in nearly 12 years

I often hear property buyers lamenting the shortage of stock in the current market. My impression was quite different. I thought the market was well stocked. High demand created by low interest rates was causing properties to be sold in incredible short periods of time. Anecdotal evidence suggests many properties are not being fully marketed but are being sold in anything from 1 – 21 days from going onto market. I find it hard to believe the market has been fully explored in such a short time, particularly when many agents are relying on their own data bases as the primary source of finding buyers.

Corelogic has just provided the numbers. In a recent report Tim Lawless shows the true numbers of properties being sold. It will surprise.

Written by Tim Lawless – Economist at Corelogic

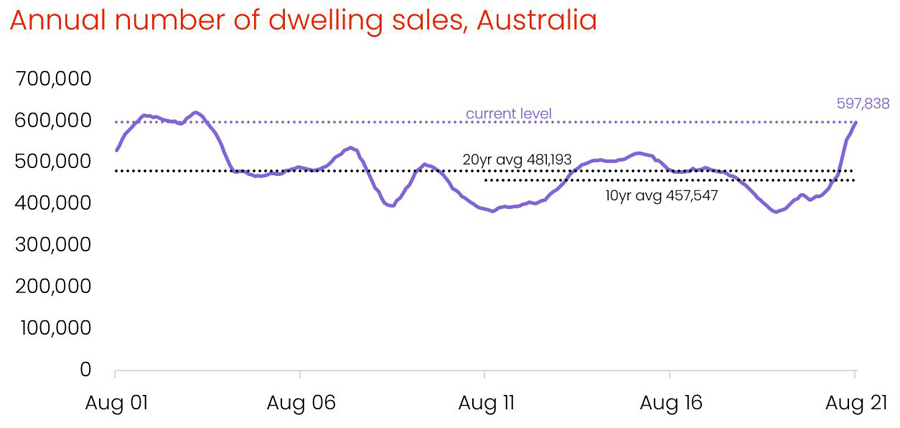

CoreLogic estimates there were almost 598,000 house and unit sales across Australia over the year ending August 2021; the highest number of annual sales since 2004 and a 42% lift on the annual number of sales over the previous 12-month period. Nationally, the number of dwellings sold over the past year was 31% above the decade average and 24% higher than the 20-year average.

Across the states, annual home sales are substantially higher than a year ago, with every state and territory, apart from Tasmania, recording a lift of more than 10% in year-on-year home sales. The smaller increase in sales across Tasmania, where advertised supply was tracking approximately 35% below average at the end of August, is probably more attributable to a lack of supply than a shortage of demand.

The largest year-on-year increase in annual home sales can be seen in the previously weaker markets of Western Australia and Northern Territory where the market is playing catch up. Year-on-year home sales have risen by 62% and 59% respectively, while Queensland has recorded a 54% lift in year-on-year sales.

uch a significant surge in housing demand may seem surprising at a time when overseas migration has stalled, however the substantial rise in home sales can be explained by a lift in domestic demand from previously low levels.

Housing turnover (annual home sales as a percentage of total dwellings) trended lower from late 2015 as credit conditions tightened, housing affordability became more challenging and transaction costs such as stamp duty became increasingly expensive as prices rose. National turnover reached a record low in June 2019 when only 3.7% of Australian homes transacted over the year. Since then credit policies have loosened and mortgage rates have reduced to record lows, encouraging more Australians to participate in the housing market. Additionally, a higher rate of household savings since March 2020 has boosted consumer deposit levels and mortgage serviceability, while government incentives such as stamp duty concessions and deposit guarantees have also supported demand.

By the end of August 2021, housing turnover had risen to 5.6%, the highest rate since December 2009.

Across the states, turnover was the highest in Queensland, where 6.8% of properties transacted over the year to August, the Sunshine State’s strongest turnover level since the 12-months ending June 2008. The higher rate of turnover is being supported by a surge in interstate migration along with relatively affordable housing prices compared to New South Wales and Victoria.

The ACT recorded the second highest rate of housing turnover in the last year, with 6.0% of properties selling. Similar to Queensland, Canberra’s housing market is relatively affordable when considering dwelling prices compared to incomes. A substantial lift in investment activity also helps to explain the higher rate of turnover, with the value of investor lending rising from 17.1% of all lending in January 2020 to almost 31% in July 2021.

Turnover was the lowest in the Northern Territory, with only 3.7% of properties trading over the past year, up from a recent low in June last year when only 2.4% of properties transacted over the year. Despite home sales surging almost 60% over the past year, annual sales were still 12% below the 20-year average across the NT, highlighting how strong demand has been through previous growth cycles.

Victoria shows the second lowest rate of housing turnover over the past year, with 4.6% of properties transacting over the past 12 months. The weaker turnover reading has been impacted by multiple lockdowns as well as worsening housing affordability. Also, a large number of newly built dwellings has added to the state’s overall housing supply. Over the past five years, Victoria’s dwelling count has increased by 280,900, the largest increase of any state or territory.

Recent Comments